5 Easy Facts About Pkf Advisory Services Shown

5 Easy Facts About Pkf Advisory Services Shown

Blog Article

Everything about Pkf Advisory Services

Table of ContentsThe Ultimate Guide To Pkf Advisory ServicesAbout Pkf Advisory Services4 Simple Techniques For Pkf Advisory ServicesThe Main Principles Of Pkf Advisory Services Excitement About Pkf Advisory Services

The majority of people nowadays know that they can not count on the state for greater than the absolute basics. Planning for retirement is a complicated organization, and there are various choices available. A financial advisor will not just help sort with the numerous regulations and item options and help build a profile to increase your long term leads.

Getting a house is among the most expensive choices we make and the large majority people require a mortgage. An economic consultant might save you thousands, particularly at times like this. Not only can they look for the very best prices, they can help you evaluate practical degrees of loaning, make the many of your deposit, and might additionally discover lending institutions that would certainly or else not be available to you.

Get This Report on Pkf Advisory Services

A financial advisor understands how items work in various markets and will certainly identify possible disadvantages for you as well as the potential advantages, so that you can after that make an educated decision regarding where to invest. Once your risk and financial investment assessments are total, the next action is to take a look at tax obligation; even the a lot of standard review of your setting might assist.

For more difficult arrangements, it might suggest relocating assets to your partner or kids to increase their personal allowances instead - PKF Advisory Services. A financial adviser will certainly constantly have your tax setting in mind when making recommendations and factor you in the right instructions even in complicated situations. Also when your investments have been placed in place and are going to plan, they need to be kept track of in case market growths or abnormal occasions push them off program

They can examine their efficiency versus their peers, guarantee that your possession allowance does not come to be altered as markets rise and fall and aid you settle gains as the deadlines for your utmost objectives move better. Cash is a complicated topic and there is lots to consider to secure it and take advantage of it.

What Does Pkf Advisory Services Do?

Utilizing a great economic adviser can puncture the hype to steer you in the ideal direction. Whether you need general, functional advice or a specialist with dedicated know-how, you can find that in the long-term the cash you spend in skilled recommendations will be paid back lot of times over.

Preserving these licenses and certifications calls for continual education, which can be costly and taxing. Financial consultants require to remain updated with the latest sector trends, policies, and my response finest practices to serve their customers effectively. In spite of these obstacles, being a certified and qualified financial advisor uses enormous benefits, consisting of countless job chances and greater earning capacity.

Some Of Pkf Advisory Services

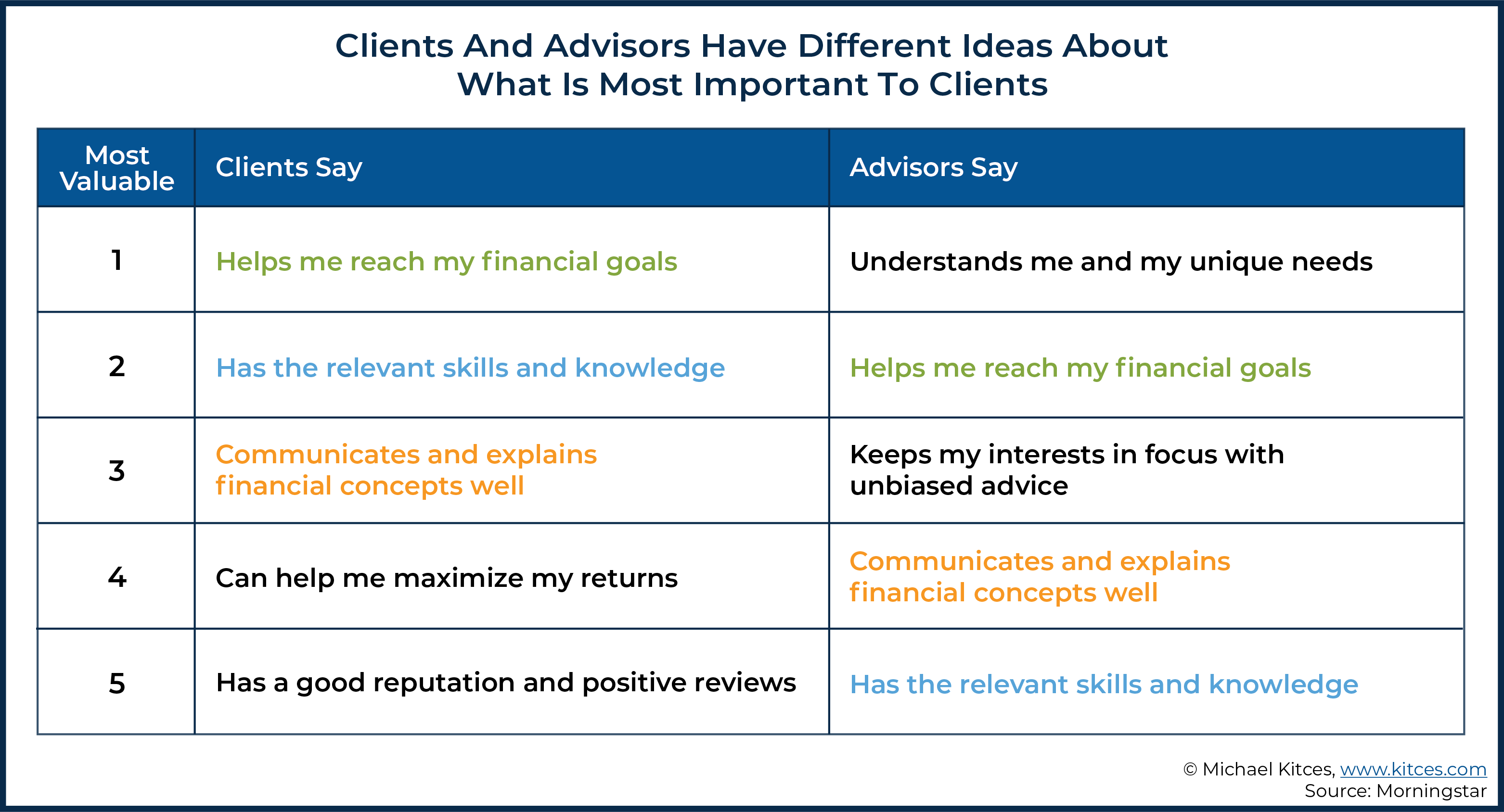

Compassion, logical skills, behavior finance, and excellent interaction are extremely important. Financial experts function closely with clients from varied backgrounds, helping them browse intricate financial decisions. The capacity to listen, comprehend their special demands, and supply customized suggestions makes all the difference. Remarkably, previous experience in financing isn't constantly a my company prerequisite for success in this field.

I started my job in corporate finance, walking around and up throughout the business finance framework to refine abilities that prepared me for the duty I am in today. My selection to relocate from company finance to personal finance was driven by individual requirements along with the wish to aid the lots of individuals, families, and tiny companies I presently serve! Achieving a healthy and balanced work-life balance can be challenging in the very early years of a monetary advisor's career.

The economic consultatory occupation has a positive outlook. It is expected to expand and develop constantly. The job market for individual monetary experts is forecasted to grow by 17% from 2023 to 2033, suggesting strong demand for these services. This development is driven by factors such as a maturing population needing retired life planning and enhanced awareness of the value of financial planning.

Financial advisors have the special capability to make a significant effect on their customers' lives, aiding them accomplish their financial objectives and secure their futures. If you're enthusiastic about money and aiding others, this occupation course could be the best fit for you - PKF Advisory Services. To find out more details concerning ending up being an economic advisor, download our extensive frequently asked question sheet

The Only Guide for Pkf Advisory Services

If you would like financial investment advice regarding your particular truths and circumstances, please get in touch with a certified economic expert. Any type of financial investment involves some level of danger, and various types of investments include varying degrees of threat, including loss of principal.

Past performance of any kind of safety, indices, approach or allocation may not be a measure of future results. The historic and current details as to policies, regulations, guidelines or advantages consisted of in this file is a summary of details gotten from or prepared by various other resources. It has not browse this site been independently verified, but was acquired from resources believed to be trusted.

A monetary expert's most beneficial property is not proficiency, experience, or even the capacity to create returns for customers. It's trust fund, the structure of any type of effective advisor-client partnership. It establishes an expert apart from the competition and keeps customers coming back. Financial professionals across the nation we interviewed concurred that depend on is the crucial to constructing long lasting, efficient relationships with customers.

Report this page